Articles Articles |

Daniel R. Amerman, CFA, InflationIntoWealth.com

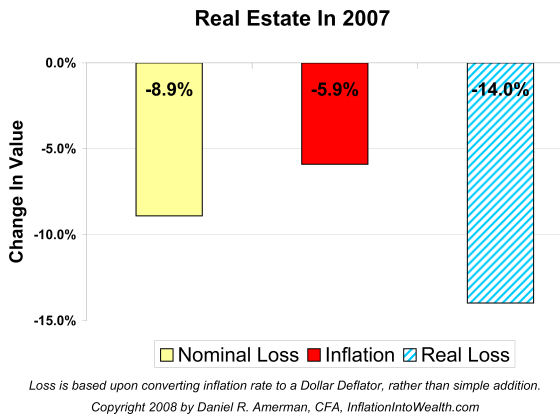

It has been widely reported that the United States housing market fell by 8.9% in 2007. As we will explore in this article – when we include inflation, the real decline in single-family home values was 50% higher than reported. For 2007 was not just the worst year for housing in the 20 year history of the S&P/Schiller index, but the worst year for inflation in 17 years. The forces of asset deflation were not battling the forces of monetary inflation – they were working as a team to pull down the real net worth of tens of millions of homeowners.

As we will see, there is no time that monetary inflation is more deceptive – or dangerous – than when it is working with asset deflation, its oftentimes partner in crime. What happens when monetary inflation meets asset deflation is not understood by most of the population. Hidden within the convergence of those two fundamental forces will be the likely “solution” to the current housing crisis, as well as opportunities for astute individuals to protect and even increase their net worth during a time of falling real home prices.

(This article is part of the Why Inflation Will Trump Deflation series, and contains Reason Five. It can be read on its own, and does not require reading the previous articles in advance.)

As prominently reported in the national media, there was an 8.9% fall in the average value of single family homes in the United States in 2007 (according to the S & P / Case-Schiller U.S. National Home Index). This was the largest annual loss in the 20-year history of the index. This number was literally true – but economically it was less than fully accurate, for it left out something very important indeed. For 2007 was not only the worst year for the real estate market in years – but the worst year for the dollar. Between January 1st and December 31st of 2007, the US Consumer Price Index (CPI) rose by 4.1%, the largest calendar year increase in 17 years. When we look at wholesale inflation, which tends to lead consumer inflation, the 12 month Producer Price Index (PPI) jumped 7.4% between January of 2007 and January 31 of 2008 – the highest 12 month rate of inflation seen in 26 years.

(For the rest of this article we’re going to treat current inflation as being 5.9%, which is the blended average of the January 12 month CPI & PPI rates of 4.3% and 7.4% respectively. This is offset by one month from the housing index, but better reflects the year-end trends we’ll discuss in a bit.)

The most important thing to remember about inflation is that it is both a liar and a thief. A thief because it quietly takes from your net worth through reducing the value each year of what your dollars will buy. What makes inflation a particularly clever thief is that it is a liar that hides genuine losses, even as it presents false profits. For example, let’s say you have an asset worth $100,000, and there is a 5% inflation rate. The asset keeps up with inflation, and is therefore worth $105,000 at the end of the year. Now, that sure looks like a $5,000 profit – and it is taxed as a $5,000 profit. But it isn’t, because inflation took $5,000 of your purchasing power, and all you did was break even. Your $105,000 at the end of the year will buy you no more reality (goods and services) than your $100,000 would have at the beginning of the year, and your “profit” was a (fully taxable) lie.

Which raises the question: what happens if your asset doesn’t keep up with inflation? That brings us back to the single-family home market in 2007, and the chart below:

To explore what the graph means, we’ll use an example home. Let’s assume you started off with a home that was worth $300,000 at the beginning of 2007. If its value changed exactly like the national average for single family homes over the year, by the end of the year it would have lost 8.9% of its value, and be worth $273,000, for a loss of $27,000. Ouch! Except, that is only part of the damage, because those dollars at the end of 2007 wouldn’t buy as much as they did at the beginning of the year. Economists use the terms “nominal” and “real” to distinguish between the dollars themselves, and the separate issue of what those dollars will buy. Our $273,000 is simply the number of dollars, the nominal – and what it omits is that the purchasing power of each of those dollars has fallen over the year.

| Click Here To Learn About A Free Mini Course That Will Teach You How To Turn Inflation Into Wealth. |

To find the real, we need to adjust for the 5.9%rate of inflation. When we do that, we find that $273,000 at the end of the year would only buy what $258,000 would have bought at the beginning of the year. So the decline in the simple (nominal) value of our house cost us $27,000, and the decline in the value of what a dollar will buy cost us another $15,000, and at the end of the year – in real terms – we lost a total of $42,000. Our real loss was 14%, which was a full fifty percent higher loss than the 8.9% that was publicly reported. In other words, the average homeowner in America took a loss that was 50% greater than what was reported in the papers and on TV.

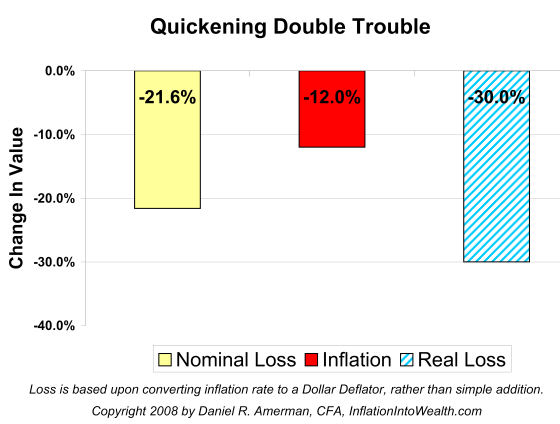

What makes the situation even more disturbing is when we look at more recent numbers. The 8.9% decline in housing prices was not evenly spread over the year – rather, 5.4% of it occurred in the last 3 months of the year, and only 3.5% occurred during the first nine months. If we consider simple averages, the monthly decline in nominal housing prices accelerated from 0.4% in the first three quarters of the year to 1.80% monthly in the last quarter, a deflationary acceleration of 350%. Using simple annualization (multiplying times 12 rather than using an exponential function), that means the nominal rate of housing deflation increased from 4.8% in the first 9 months of 2007, to 21.60% in the last 3 months of 2007.

The last few months of 2007 and the first month of 2008 also made big news in another area as well. In January of 2008 the PPI – the measure of wholesale inflation – jumped to a monthly rate of 1%, which equals a full 12% annual rate of inflation. More than any other single number, this one month acceleration is what accounted for the 12 month PPI reaching its highest annual rate of increase in 26 years.

In other words, we have a double acceleration in progress. It’s not just that houses are deflating at the highest rate in the 20 year history of the index – or that 12 month inflation as measured by the PPI just hit its highest level in 26 years – but that both of these annual records are the result of a quickening that occurred in the last few months of 2007 and the first month of 2008 (for the PPI and CPI). What happens if these accelerated short term rates continue for the rest of 2008?

As an illustration, the graph above extrapolates the October to December 2007 rate of housing deflation, and combines it with the January 2008 rate of monetary inflation. When the deflation rate is annualized, the average house loses 21.6% in dollar terms. When the inflation rate is annualized, the dollar loses 12% in purchasing power terms. And when deflation meets inflation – the average home would experience a 30% combined fall in real value in 2008, if these rates were to persist.

What does that mean in dollar terms? Let’s go back to our example where we start the year with a $300,000 house. If you experience a 21.6% deflation in simple (nominal) terms, that would drop the dollar value of your home to $235,000. When we adjust for what a 12% rate of inflation will do to what a dollar will buy, the value of your home has now fallen to $210,000. In other words, if we extrapolate forward the most recent inflation and housing figures, your real loss could be $90,000, or a full 30% of the value of your home in one year.

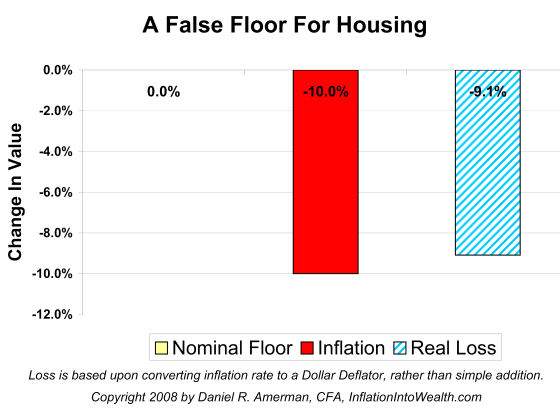

The above is intended to be an illustration rather than a projection or a prediction. Monthly and quarterly rates do bounce around quite a bit, and hopefully things won’t work out quite as badly as a straight extrapolation of recent asset deflation and monetary inflation rates would indicate. However, I think that we can make a prediction that something else will happen. At some point, whether it is this year or three years from now, we will reach what will be called a floor. It will be widely reported that the damage has been stopped!

Be very careful about what you believe – because what you will likely be seeing is a false floor that is based upon the lie of inflation. This is illustrated in the graph below:

For if asset prices stabilize, but monetary inflation has not – then a floor is not a floor at all, but rather a continuing plunge that has been hidden by that old liar we know as inflation. If housing prices stabilize, and do not rise or fall, but the rate of inflation is equal to 10% -- then you have just lost a further 9% of the value of your home. (See (*) at the end of the article for why a 10% rate of inflation drops the value of a house by 9%).

This loss has been masked by a façade – the false income of inflation. The false income of a dollar being worth a dollar, regardless of how much the dollar will buy. When we strip away the false income, we are left with reality. The market will have kept right on falling. Indeed, with the example above, the loss in real wealth would slightly exceed the 8.9% reported by the media for 2007 – even as the turn in the housing market is triumphantly announced to the relief of all.

To illustrate, we will go back to our $300,000 house. Which both starts and ends the year at a value of $300,000. To the immense relief of all! Except that the $300,000 at the end of the year will only buy what $273,000 would at the beginning of the year. So we have indeed lost $27,000 of our house’s value, even as the headlines tell us otherwise.

What the above illustrates is a definition for asset deflation that is well understood by economists and financial analysts, but one that is not necessarily used by all of the general public. The simple approach that is taken in some articles on the subject is to lump the value of money together with the value of assets, and say that if the price of an asset goes up, it is asset inflation, and if it goes down, it is asset deflation. Unfortunately, this simplistic approach hides what matters – the purchasing power you can get through selling an asset – behind a screen of monetary inflation. If your asset doubles in price, but a dollar will only buy what a quarter used to, then you didn’t double your money, you just lost half your savings, and any measure that doesn’t pick up on the difference isn’t worth using.

The better approach, indeed the absolutely necessary approach for intelligent decision making, is to first adjust asset values for inflation, and then determine whether the value of what that asset will buy for you is rising – or falling. For instance, hyperinflation can be the most devastating form of asset deflation for an investor, yet this deflation can be missed entirely when using the common but simplistic definition for asset deflation that uses nominal dollars only. (That’s all there is room for on that subject in this article, but look for more in later articles.)

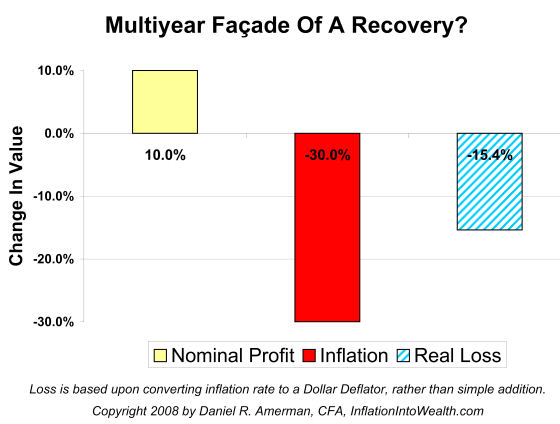

This brings us to the time that we all look forward to even more than the floor – and that will be the recovery. The time when we recoup our losses and actually start making money again. As we leave behind us the times of falling prices, and move into a new era of home based prosperity, real estate agents will form spontaneous conga lines as the party spills out into the streets. Mortgage brokers will be swinging from the chandeliers in a coast to coast party as the good times return.

Except… the recovery might not be quite as real as it looks, as illustrated in the graph below.

In this illustration it is several years down the road, and the housing market has recovered and then some. Our $300,000 house is now worth $330,000 and we are building positive equity again! Time for a new home equity line! Except… except… when we take that darned approach of looking not at money, but what money will buy. Let’s say that monetary inflation has cost us 30% of the purchasing power of our dollars over the course of the several years it takes housing prices to “recover”. When we include the value of what dollars will buy, then instead of making a 10% profit – we will still be 15% “in the hole”. Instead of being $30,000 ahead, we will still have a $46,000 loss in terms of what our house will buy for us, if we were to sell it and try to spend the value. That purchasing power hole will still very much be there when it comes down to the ultimate reality check – how much is our net worth, and how much will it buy for us?

As we mentioned above, inflation is not only the most clever of thieves, but the most skillful of liars. The key to understanding the inflation lie in the example above (which will dominate headlines around the country) – is that every bit of the “profit” will actually be inflation, and not profit at all. The higher dollar price merely means that your dollars will buy much less than they used to.

The above brings us to Reason Five in our series, Why Inflation Will Trump Deflation. Our fifth reason is simply that the above scenario – or something like it – will work. A façade of a housing recovery where real losses are hidden behind a veil of inflation will work from a governmental perspective, from an industry perspective, and from an economic perspective. It has reliably worked in the past, and it will work again. Because at its core, economics isn’t about equations at all – it is about people. Us quirky, sometimes emotion driven, often less than completely rational people, with all the innumerable imperfections that we together share. Collectively and individually, we base our behavior not upon “truth”, but upon what we perceive to be truth. If we think that the recovery is here, we will act as if the recovery is here – and the economic equations will follow our behavior

On the other hand, if we don’t experience substantial monetary inflation and we instead have both substantial home value deflation and monetary deflation (or even level dollar values) – then everything breaks. We can’t sell a house without recognizing a massive and unmistakable loss, with no nominal dollars or purchasing power nuances involved. We can’t sell, nobody buys, consumer spending spirals down, foreclosures accelerate, housing prices fall some more, the economy goes further down the tubes, the financial markets continue to implode, a long series of dominos fall, and a new depression possibly settles over the country. An unnecessary depression (at least from that angle) as far as the government is concerned, and one they are hoping to prevent.

Enter “Helicopter Ben” Bernanke from stage left. Whose selection as Federal Reserve Board Chairman likely had a very great deal to do with his theories that much of the worst of the Great Depression of the 1930s could have been averted if changes to monetary policy had changed people’s perceptions, and then their behavior. Which is a long way of saying that to avert depression – and battle deflationary forces – the dollar must die, if need be. (And sorry about the value of your life savings, but making omelet’s, breaking eggs, etc., etc.)

Could the people really be fooled like that? Believe that they are making money while they lose purchasing power? Unfortunately – of course they could. For instance, let’s consider the last time that the United States had the combination of substantial inflation, recession, a troubled housing market, rapidly rising energy costs, and a mortgage industry in crisis that was ultimately bailed out by the Federal Government. That time was the 1970s and early 1980s, and it was the last time we saw inflation as high as the recent Producer Price Index numbers.

Now, the interesting part is that millions of American households considered those tumultuous years to be the best years of their lives for home ownership as they made huge amounts of money due to inflation in the housing markets and price of homes. Or so they thought, until we add that technicality of looking not at dollars, but what dollars will buy. When we do that, then (as extensively documented in my book, “The Secret Power Within Your Mortgage”) the average home experienced deflation in purchasing power terms over those years, with the real price of housing falling 3% during the decade from 1972 to 1982. Most people who simply owned a home free and clear actually lost money in real terms during that time.

Yet, where things get still more interesting is that millions of American households did experience major increases in their after-inflation and after-tax net worth during this time of financial turmoil, and indeed, this increase still forms the core of their assets for many retirees today. During the same decade that the value of the DJIA was falling 62% in inflation-adjusted terms (with that massive degree of asset deflation being mostly hidden behind monetary inflation), millions of homeowners did indeed more or less accidentally turn the combination of 3% home value deflation – and an 8.7% average annual monetary inflation rate – into (on average) the after-tax and after-inflation net worth improvement equivalent of a conventional investment earning 22% annually for 10 years (as covered in Reading Nine of the Turning Inflation Into Wealth mini-course).

American households were actually using monetary inflation to fight asset deflation in a time of stagflation – and achieving superb results – but the average person had no idea how they were doing this, or even that they were doing it at all. The difference this time around is that to effectively fight a potential 20% to 30%+ housing market deflation in real terms, is likely going to take more than a simple accident. We will have to truly understand what happened the last time around if we are to deliberately and successfully use monetary inflation to offset asset deflation losses during our current fast-developing time of financial upheaval.

This means looking inflation straight in the eye and saying: “Inflation, you are likely to play a big role in my personal future, and instead of ignoring you or thoughtlessly flailing away at you – I will study you and your ways. I will learn the deeply unfair ways in which you redistribute wealth, and the counterintuitive lessons about how some investors will be destroyed by inflation and repeatedly pay taxes for the privilege, even while other investors are claiming real wealth on a tax-free basis. I will learn to position myself so that you redistribute wealth to me, and the worse the financial devastation you wreak – the more my personal real net worth grows. I will examine the official blindness to inflation within government tax policy that creates the Inflation Tax, and instead of raging or despairing, I will understand that a blind opponent is a weak opponent, and I will take advantage your blindness and use tax policy to multiply my real wealth.”

Do you know how to Turn Inflation Into Wealth? To position yourself so that inflation will redistribute real wealth to you, and the higher the rate of inflation – the more your after-inflation net worth grows? Do you know how to achieve these gains on a long-term and tax-advantaged basis? Do you know how to potentially triple your after-tax and after-inflation returns through Reversing The Inflation Tax? So that instead of paying real taxes on illusionary income, you are paying illusionary taxes on real increases in net worth? These are among the many topics covered in the free “Turning Inflation Into Wealth” Mini-Course. Starting simple, this course delivers a series of 10-15 minute readings, with each reading building on the knowledge and information contained in previous readings. More information on the course is available at InflationIntoWealth.com .

Contact Information:

Daniel R. Amerman, CFA

Website: http://InflationIntoWealth.com/

E-mail: mail@the-great-retirement-experiment.com

(*) The loss is 9% rather than a simple 10% because we have to convert from the inflation rate to a dollar deflator, in order to calculate declines in purchasing power. This need to convert inflation into a deflator actually gets to the heart of one of the most deceptive aspects of inflation – we measure inflation as an increase, and discuss it as an increase, but the real nature of inflation is actually to deflate the value of each dollar, hence the need for the conversion to a dollar deflator. This is not only confusing mathematically – but can be intuitively confusing for many people as well.

This essay and the websites, mini-course, books and audio recordings, contain the ideas and opinions of the author. They are conceptual explorations of general economic principles, and how people may – or may not – interact in the future. As with any discussion of the future, there cannot be any absolute certainty. What this website does not contain is specific investment, legal or any other form of professional advice. If specific advice is needed, it should be sought from an appropriate professional. Any liability, responsibility or warranty for the results of the application of principles contained in the website, pamphlets, recordings, books and other products, either directly or indirectly, are expressly disclaimed by the author.